Getting better…

Navigating Opportunities in the 2026 Real Estate Landscape: A Balanced Perspective

Navigating Opportunities in the 2026 Real Estate Landscape: A Balanced Perspective

As we step into 2026, the real estate market appears poised for a subtle yet significant shift—what some experts are calling a "great housing reset." After years of volatility driven by pandemic-era disruptions, inflationary pressures, and fluctuating interest rates, the coming year offers a canvas of opportunities for investors, buyers, and developers alike. Drawing from recent forecasts and analyses, this post explores potential avenues for growth and innovation in both residential and commercial sectors. It's fascinating to consider how these trends, grounded in economic data and expert insights, could reshape our built environment in ways that feel both predictable and refreshingly human.

Residential Real Estate: Modest Growth Amid Improving Affordability

In the residential arena, 2026 is expected to bring a steadier market, with affordability inching forward as wage growth begins to outpace home price appreciation for the first time since the Great Recession. This dynamic presents intriguing opportunities for first-time buyers and investors who have been sidelined by high costs. Median existing-home prices are projected to rise modestly by about 2.2%, reflecting a balanced supply-demand equation rather than the frenzied escalations of prior years. Empirical evidence from market forecasts suggests that monthly housing payments could decrease by around 1.3%, dropping the share of income devoted to mortgages below 30%—a threshold not seen since 2022.

One particularly promising area lies in regional variations, where micro-markets could yield outsized returns. For instance, locales like Baton Rouge, Louisiana, and Grand Rapids, Michigan, are anticipated to see sales growth of 7.1% and 6.9%, respectively, alongside healthy price appreciation in places like Hartford, Connecticut (up 9.5%). Conversely, cooling markets in the South, such as Nashville and Austin, might offer bargains for savvy investors willing to navigate higher insurance costs and post-disaster inventories. It's worth noting that move-in-ready homes—fully renovated and even furnished— are likely to command premiums, sparking bidding wars in a landscape where renovation costs continue to climb. For those with a long-term view, converting unsold properties into rentals could capitalize on softening rent growth in oversupplied regions like Las Vegas and Atlanta, where rents may decline by 1%.

Moreover, the rise of multigenerational living arrangements opens doors for developers specializing in adaptable homes with extended family suites. As younger generations grapple with affordability, sharing equity through innovative agreements—think "prenups" for co-ownership—could become more commonplace, fostering opportunities in niche financing and legal services tailored to these setups.

Commercial Real Estate: Sector-Specific Revivals and Adaptations

Shifting to commercial real estate, 2026 holds potential for recovery in key segments, albeit tempered by macroeconomic factors like tariffs and consumer spending patterns. Office demand is set to continue its rebound, driven by hybrid work models that prioritize high-quality, amenity-rich spaces. This trend could benefit investors in urban cores or suburban hubs where employers seek to lure talent back with collaborative environments. Similarly, industrial real estate may see redefined demand due to new tariffs, prompting reshoring of manufacturing and increased need for warehousing near domestic ports and supply chains.

Retail, influenced by a "K-shaped" consumer economy—where high-income shoppers thrive while others retrench—offers opportunities in experiential and value-oriented spaces. Think mixed-use developments that blend shopping with entertainment, or adaptive reuse of vacant big-box stores into community hubs. Analysis indicates that early indicators of economic softening could accelerate these adaptations, rewarding forward-thinking developers who anticipate shifts in spending behavior.

Emerging Trends: Technology, Sustainability, and Policy Influences

Beyond traditional sectors, 2026's real estate opportunities are amplified by technological and environmental imperatives. Artificial intelligence is poised to transform the industry, not by displacing human agents but by enhancing efficiency— from precise pricing models that account for renovation quality and views to streamlined lease processes. For entrepreneurs, investing in AI-driven platforms could yield dividends, particularly in home search tools that demystify risks and tradeoffs for buyers.

Sustainability emerges as another fertile ground, with climate resilience features like flood mitigation and energy backups becoming decisive factors in buyer preferences, especially in vulnerable areas such as Florida and wildfire-prone California. Hyperlocal climate migration within metros—relocating to less risky neighborhoods—could drive demand for resilient retrofits, creating niches for specialized contractors and insurers.

Finally, policy interventions, including YIMBY (Yes In My Backyard) zoning reforms and incentives for manufactured housing, signal long-term potential for addressing supply shortages. While full relief may take years, early movers in affordable housing development could position themselves advantageously as governments push for increased inventory.

Concluding Thoughts: A Cautiously Optimistic Horizon

In sum, the 2026 real estate market, while not explosive, offers a mosaic of opportunities rooted in stabilization and innovation. Whether through targeted residential investments, commercial revitalizations, or embracing tech and green trends, stakeholders who approach the landscape with data-informed agility stand to benefit. Of course, uncertainties like labor market weakness and persistent inflation remind us that real estate remains as much an art as a science—human decisions, after all, drive the numbers. As always, consulting local experts and diversifying strategies will be key to navigating this evolving terrain. What excites me most is the potential for these changes to make housing more accessible and sustainable, ultimately benefiting communities in tangible ways.

Trump and Venezuela. The Real Reason the News Missed.

The biggest economic boom in American history just started.

Here's everything you need to know:

Trump captured Venezuela's communist president and seized $17.3 trillion in oil reserves.

Venezuela has 303 billion barrels of crude oil - which the US now controls.

At $57/barrel, that's $17.3T in value. Even selling at half-market rate?

$8.7 trillion. Almost a third of the National debt — secured in 3 hours.

But this was more than securing oil, ending drugs, or stopping terrorism.

It was about protecting the US dollar as the world's reserve currency.

In 1974, Kissinger made a deal with Saudi Arabia: "all oil sold globally must be in US dollars." China was hours away from ending that.

China was on the verge of making the Yuan the new world currency:

→ Built cips (alternative to SWIFT and onboarded 4,800 banks)

→ BRICS was designed to bypass the US Dollar

→ Russia secretly sold oil in China and even met with Maduro the same day Trump acted.

300b+ barrels of crude oil would've been the final piece...

In one move, America just secured:

→ the largest oil reserves on Earth

→ fuel for the $10T AI + EV boom

→ energy dominance over China

All while ending the nightmare Venezuelans have lived under for years.

This may have been one of the biggest power moves in world history.

…plus… it puts others in the region on notice. “You may talk tough, but we just snatched the President with the biggest army out of his bed, with his wife, in the middle of the night, (without a scratch on our side), in under 7 minutes. If we want to get you, we’ll get you”.

Happy New Year

So…. it has been a really, really, really difficult year. But we have made so much progress and so many new things are ready to launch. I know that the whole “New Year, New Me” thing is trite and overdone, and doesn’t really apply to business anyway. But I will say this… we have a plan, and I think you are going to be pleasantly surprised.

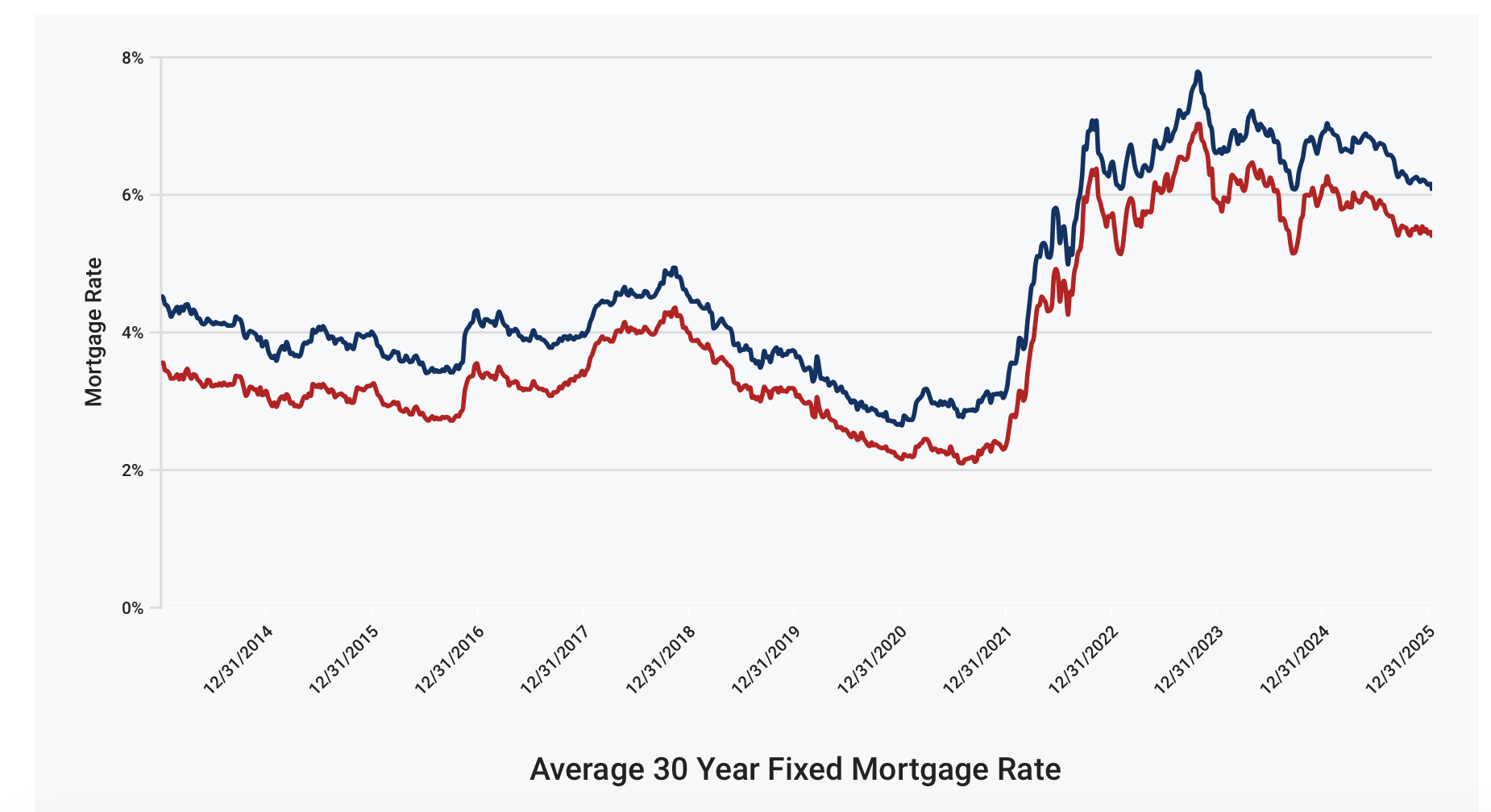

The Fed Lowered Rates Why Did Mortgage Rates Go UP?

I’ve Mentioned This Before, and I’m Saying It Again: Don’t Keep Pushing for More Fed Rate Cuts If You’re Hoping for Lower Mortgage Rates.

Here’s a clear explanation to share with your clients:

Fed rate cuts can spark concerns in the markets about potential inflation picking up again.

That worry often leads to higher inflation expectations baked into bond yields—which essentially pushes longer-term rates upward.

So, what should the mortgage and housing sector actually want from the Fed to help bring mortgage rates down?

It’s straightforward: Maintain a mildly restrictive policy stance a bit longer, until there’s undeniable evidence of steady, sustainable progress toward the 2% inflation goal, silencing the remaining inflation concerns.

We don’t have to hit exactly 2% by next year; we simply need services and goods prices to keep easing gradually toward around 2.4% or so in the coming 6-9 months.

Feel free to pass this along to your borrowers when they call today or tomorrow wondering why mortgage rates didn’t drop after yesterday’s Fed move. Hope this is useful—let me know your take!

Fannie Mae Just Eliminated the 620 FICO Minimum: What It Really Means for Homebuyers and the Mortgage Industry

Fannie Mae Just Eliminated the 620 FICO Minimum: What It Really Means for Homebuyers and the Mortgage Industry

For more than two decades, a single number has stood like a brick wall between millions of Americans and conventional homeownership: 620.

If your FICO score was 619 or lower, Desktop Underwriter—the automated underwriting engine used for roughly 60% of all conforming mortgages—wouldn’t even let you in the door. No exceptions, no appeals, no matter how much cash you had in the bank or how low your debt-to-income ratio was.

That wall comes down this Saturday, November 16, 2025.

In Selling Guide update SEL-2025-09 and Desktop Underwriter Version 12.0, Fannie Mae is officially removing the 620 minimum representative credit score requirement for all new loan casefiles. The change is live for any file created on or after this weekend.

What Actually Changed?

Before November 16:

Single borrower: minimum representative FICO = 620

Multiple borrowers: average median FICO = 620

Below those thresholds → automatic “Refer” or “ineligible” in DU

After November 16:

No minimum score threshold in DU for eligibility

DU will rely on its full trended credit data, cash-flow analytics, and 150+ risk factors

Third-party credit scores are still required for delivery, but they no longer act as a hard gate

In plain English: Desktop Underwriter will finally look at the whole borrower instead of rejecting them at the front door because of three digits.

Who Wins the Most?

Thin-credit borrowers Recent immigrants, young professionals, and anyone who avoids credit cards now have a real shot at conventional financing.

Self-employed and 1099 workers Gig-economy borrowers often have excellent cash flow but lumpy credit profiles. DU’s new logic can finally see the reserves and bank-statement patterns that manual underwriters have been approving for years.

“Near-miss” recovery stories Someone who had a medical collection in 2022, paid it off, but still sits at 615 because of utilization—previously locked out. Now they’re in play if everything else is strong.

Rural and underserved markets FHFA data shows persistent 580–619 score bands in many LMI census tracts. This change directly supports the Biden-era (and continued Trump-era) push for equitable access.

The Fine Print Nobody Should Ignore

This is not a free-for-all. Three big guardrails remain:

Lender overlays Most banks and IMBs will still demand 620 or higher for at least the next 6–12 months. Overlay removal lags behind guideline changes—always.

Mortgage insurance companies Arch MI, Essent, MGIC, Radian, and Enact have their own rules. Current MI guidelines typically start at 620 for standard coverage and 600 for some charter programs. Until the PMI industry updates rate cards (likely Q1–Q2 2026), loans under 620 will still face limited MI options or higher LLPAs.

Delivery requirements unchanged Fannie Mae still requires a valid tri-merge credit report and at least one score per borrower. “No score” or “invalid score” loans remain ineligible.

Timeline Recap

November 16, 2025 – DU 12.0 goes live

Existing casefiles locked before Nov 16 keep old rules

New submissions or re-submissions after Nov 16 get the new logic

Expect lender bulletins and updated overlay sheets through December

What Should Borrowers and Loan Officers Do Right Now?

Pull fresh tri-merge reports on every 580–619 borrower in your pipeline

Re-run DU on any file that was previously “Refer with Caution” solely due to score

Document compensating factors aggressively—12 months reserves, 401(k) balances, low DTI, rental history

Shop lenders—early adopters who drop overlays first will win the volume war in 2026

The Bigger Picture

Freddie Mac removed their 620 floor in Loan Product Advisor 18 months ago. Fannie Mae’s move finally creates parity across the GSEs. Combined, they purchase or guarantee roughly $1.2 trillion in new mortgages annually.

FHFA Director Bill Pulte called it “the most significant credit-policy liberalization in a generation—without increasing taxpayer risk.” Early internal testing showed less than 1% increase in projected serious delinquency rates, thanks to DU’s machine-learning enhancements.

Bottom Line

The 620 minimum wasn’t a risk-based decision—it was a 1990s relic that survived through inertia. Starting this weekend, Fannie Mae joins the 21st century.

If you or someone you know has been sitting on the sideline because “I just need to get to 620,” the wait might finally be over.

Dust off those files. The barrier just moved.

Sources: Fannie Mae SEL-2025-09, Desktop Underwriter Version 12.0 Release Notes, FHFA public statements (November 2025).

Everything Changes.

It’s been awhile. Lots of personal things in life and that got me thinking about change.

And mortgage rates just dropped, and this changes everything.

Rates are now hovering around 6.17%, the lowest level we’ve seen in three years.

And the impact this has on payments and buying power is massive.

Here’s what that actually looks like:

At the start of the year, a $720,000 mortgage meant roughly a $4,800/month payment.

Today, that same loan costs about $475 less every month.

Or, if you keep the same budget, your buying power just jumped by nearly $100,000 going from a $900,000 home to about $1 million.

This is what people mean when they say “rates drive the market.”

A small movement in rates can completely shift what buyers can afford and how competitive they can be.

For buyers, this is your window. Lower rates mean more leverage, less competition (for now), and the ability to finally get into a home that might’ve been out of reach earlier this year. Waiting for rates to drop further could mean missing the moment. Once the market catches up, prices and competition will follow.

For current homeowners, this is an opportunity to re-evaluate your financial position. Whether it’s a refinance to free up cash flow, shorten your loan term, or tap equity for other goals... a drop like this opens new doors to build wealth and stability.

And for agents, this is your time to re-engage your pipeline. Every buyer who pressed pause earlier this year now has more buying power. Every listing conversation just got easier. Use this data to educate your clients, because the professionals who lead with facts win the trust and the business.

Rates are the heartbeat of the housing market and right now, the pulse is quickening.

Less than a 1% drop can mean the difference between waiting and winning.

Don’t wait for “perfect timing.” The best opportunities are the ones you recognize before everyone else does.

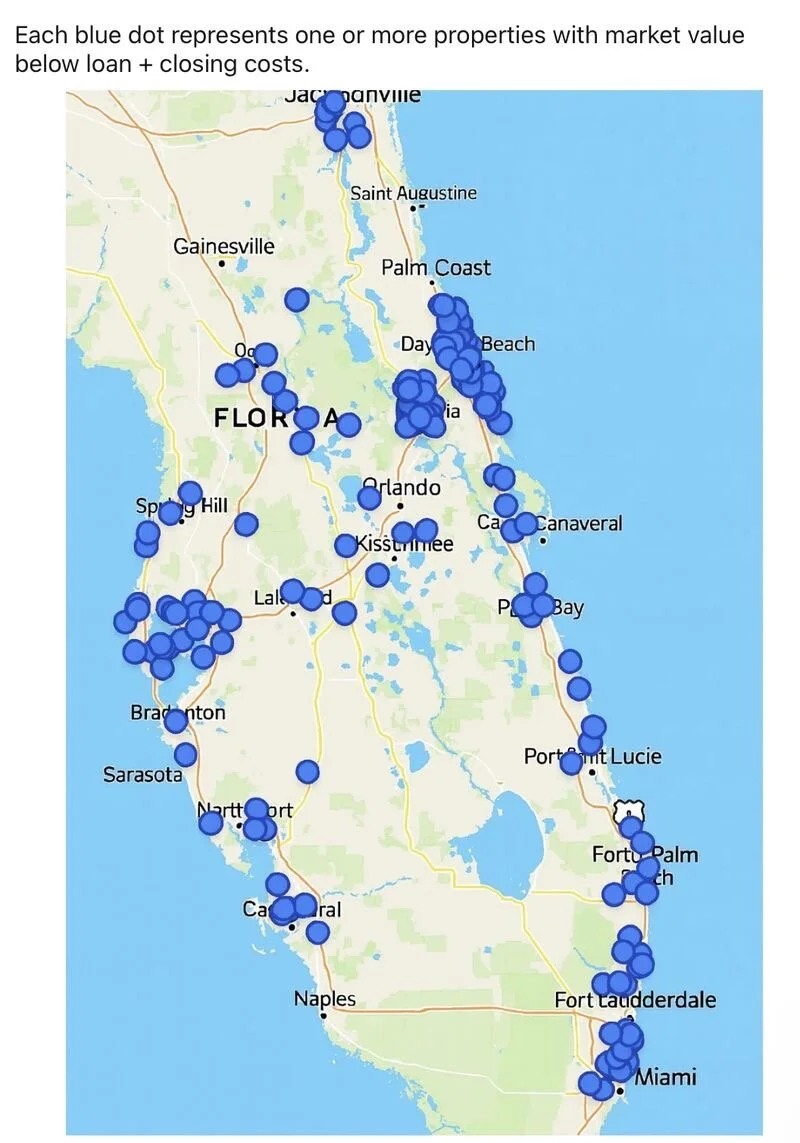

Not Another 2008... But An Opportunity.

This map highlights more than 3,600 properties now with negative equity, and the pattern isn't random with clusters forming around the state.

Miami-Ft. Lauderdale-Palm Beach (my home): Insurance and taxes are eroding values faster than expected.

Naples-Cape Coral: Investor heavy zones hit by recent price corrections and rising carrying costs.

Sarasota-Bradenton: Short-term rental demand is cooling.

Orlando-Daytona Corridor: Oversupply is meeting slower demand.

Jacksonville-Palm Coast: Delinquencies are climbing alongside higher DTI ratios.

This IS NOT another 2008, but it's a signal. Equity cushions are thinning and homeowners who were safe 6 months ago might be slipping into need-to-sell territory.

If you are an agent or an investor: Watch these hotspots closely. They are likely to generate a wave of distressed listings and good buying opportunities.

Navigating the 2025 Government Shutdown: What It Means for Your Government-Backed Loans

As of today, the United States is in the midst of its latest federal government shutdown, now entering its sixth day since funding lapsed on October 1, 2025. The Senate's repeated failure to pass bipartisan funding measures has left millions of Americans—and the economy—holding their breath. While shutdowns are more political theater than total apocalypse, they do create real disruptions, especially for anyone relying on government-backed loans to buy a home.

A Quick Primer: What Happens During a Government Shutdown?

In simple terms, a shutdown occurs when Congress can't agree on a federal budget, forcing non-essential government operations to pause. Essential services—like air traffic control or Social Security payments—continue, but agencies like the Department of Housing and Urban Development (HUD), Veterans Affairs (VA), and the Small Business Administration (SBA) often see staff furloughs and delayed processing. This isn't the first rodeo (remember 2018-2019?), but with the 2025 impasse showing no quick end in sight, it's worth understanding the hits to loan programs that millions depend on.

Government-backed loans make up a huge chunk of the U.S. lending market: FHA insures about 10-15% of mortgages, VA supports veterans' homeownership, USDA aids rural buyers, and SBA fuels small businesses. Here's how the shutdown could throw a wrench in those gears.

Impact on FHA Loans: Delays in Processing and Endorsements

FHA (Federal Housing Administration) loans, popular for first-time buyers with lower down payments, are backed by HUD. During a shutdown, HUD's reduced workforce means slower loan endorsements—the final step where the government guarantees the loan.

What's affected? New loan applications might face processing backlogs, potentially delaying closings by weeks. Existing loans aren't at risk of defaulting due to the shutdown, but if you're mid-process, expect hiccups in paperwork reviews.

Real-world example: In past shutdowns, FHA case numbers (required for origination) took longer to issue, stalling deals.

Flood insurance tie-in: FHA loans often require flood coverage through FEMA, which could also lag, adding another layer of delay.

If you're an FHA borrower, check with your lender for contingency plans—many can work around minor delays by prepping docs early.

VA Loans: Veterans' Benefits on Hold, But Not Hopeless

For active-duty service members, veterans, and eligible spouses, VA loans offer no-down-payment perks backed by the Department of Veterans Affairs. Shutdowns hit here too, with furloughed VA staff slowing certificate of eligibility (COE) issuance and appraisal processing.

Key disruptions: Loan guarantees—the VA's stamp of approval—could be postponed, pushing back closing dates. In the 2019 shutdown, some veterans waited months for resolutions.

Bright side: Lenders like Veterans United have histories of troubleshooting with the VA to keep borrowers on track, often using automated systems for COEs.

Broader effects: Related benefits, like GI Bill payments, might also pause, indirectly stressing finances for military families.

Pro tip: If you're a vet in the loan pipeline, reach out ASAP—many VA-approved lenders maintain hotlines for shutdown-specific guidance.

FHA

Slower endorsements & flood insurance

2-4 weeks

Prep docs early with lender

VA

COE & appraisal backlogs

Up to 1 month

Use automated lender tools

What Should You Do Next? Actionable Steps for Borrowers

Contact us immediately: Most are shutdown-savvy and can outline timelines or workarounds.

Monitor official updates: Check HUD, VA, USDA, and SBA websites for contingency plans—though ironic, their shutdown pages often stay live.

Build a buffer: Have extra cash for potential rate locks or temporary housing if closings slip.

Stay informed on negotiations: Bipartisan deals can resolve shutdowns overnight; follow reliable news for breakthroughs.

The Silver Lining: Shutdowns End, and Loans Endure

Government shutdowns are frustrating footnotes in history, not deal-breakers for homeownership or business dreams. While the 2025 stalemate drags on—with no resolution in sight as of October 7—these disruptions are temporary. Existing loans remain secure, and once funding resumes, agencies play catch-up fast. If you're eyeing a government-backed loan, now's the time to get your ducks in a row—delays beat derailed dreams.

What are your thoughts on this shutdown?

Drop a comment below if you're navigating a loan process right now.

Stay resilient, America.

The 1031 Exchange

Recently dear friends of mine (and wonderful clients), asked a question about a 1031 Exchange.

A 1031 exchange is a tax strategy in the U.S. that lets you sell a property you’ve been holding as an investment (like a rental property) and use the money to buy another investment property without paying taxes on the profit right away. It’s named after Section 1031 of the IRS tax code. The main idea is to "defer" (postpone) paying capital gains taxes, which you’d normally owe when you sell a property for a profit.

Here’s how it works in simple terms:

1. Sell an Investment Property: You sell a property you’ve used for investment purposes, like a rental house or commercial building. It can’t be your personal home.

2. Park the Money with a Middleman: The money from the sale goes to a qualified intermediary (a third party who holds the funds) instead of directly to you. This is important because if you touch the money, the tax break could be lost.

3. Buy a New Investment Property: Within 45 days, you need to identify a new investment property (or properties) to buy. Then, within 180 days of selling the first property, you must complete the purchase. The new property has to be of equal or greater value than the one you sold.

4. Defer the Taxes: By rolling the proceeds into the new property, you avoid paying capital gains taxes on the profit from the sale. The tax is deferred until you sell the new property (unless you do another 1031 exchange).

Key Rules to Know:

- Like-Kind Properties: The properties must be "like-kind," meaning they’re both used for investment or business (e.g., you can swap a rental house for an apartment building, but not for a personal vacation home).

- Timing: You have 45 days to pick new properties and 180 days to close the deal.

- Qualified Intermediary: You need a professional middleman to handle the money and paperwork.

- Equal or Greater Value: The new property must cost the same as or more than the one you sold to fully defer taxes.

So Why Do People Use It?

A 1031 exchange lets investors keep more money to reinvest, helping them grow their real estate portfolio without losing a chunk to taxes each time they sell. For example, if you sell a property for $500,000 that you bought for $300,000, you’d normally owe taxes on the $200,000 profit. With a 1031 exchange, you can use that full $500,000 to buy a bigger or better property instead.

Things to Watch Out For:

- It’s not a tax dodge forever; you’ll eventually pay taxes when you sell without doing another exchange.

- There are strict rules and deadlines, so it’s easy to mess up without proper planning.

- You’ll likely need to hire professionals (like a qualified intermediary or tax advisor), which adds some cost.

In short, a 1031 exchange is a way to trade one investment property for another while delaying taxes, but it comes with specific rules you need to follow carefully. If you’re thinking about doing one, it’s a good idea to talk to a tax or real estate professional to make sure it’s done right.