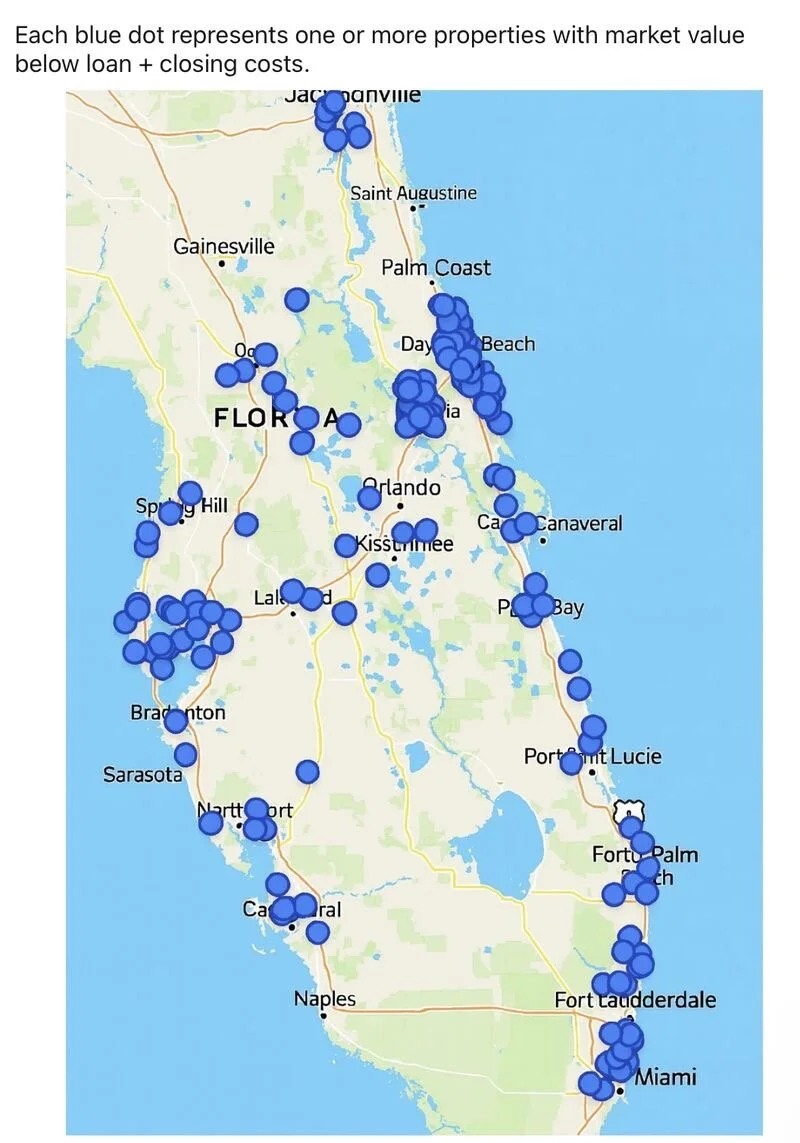

This map highlights more than 3,600 properties now with negative equity, and the pattern isn't random with clusters forming around the state.

Miami-Ft. Lauderdale-Palm Beach (my home): Insurance and taxes are eroding values faster than expected.

Naples-Cape Coral: Investor heavy zones hit by recent price corrections and rising carrying costs.

Sarasota-Bradenton: Short-term rental demand is cooling.

Orlando-Daytona Corridor: Oversupply is meeting slower demand.

Jacksonville-Palm Coast: Delinquencies are climbing alongside higher DTI ratios.

This IS NOT another 2008, but it's a signal. Equity cushions are thinning and homeowners who were safe 6 months ago might be slipping into need-to-sell territory.

If you are an agent or an investor: Watch these hotspots closely. They are likely to generate a wave of distressed listings and good buying opportunities.