What's in a Credit Score

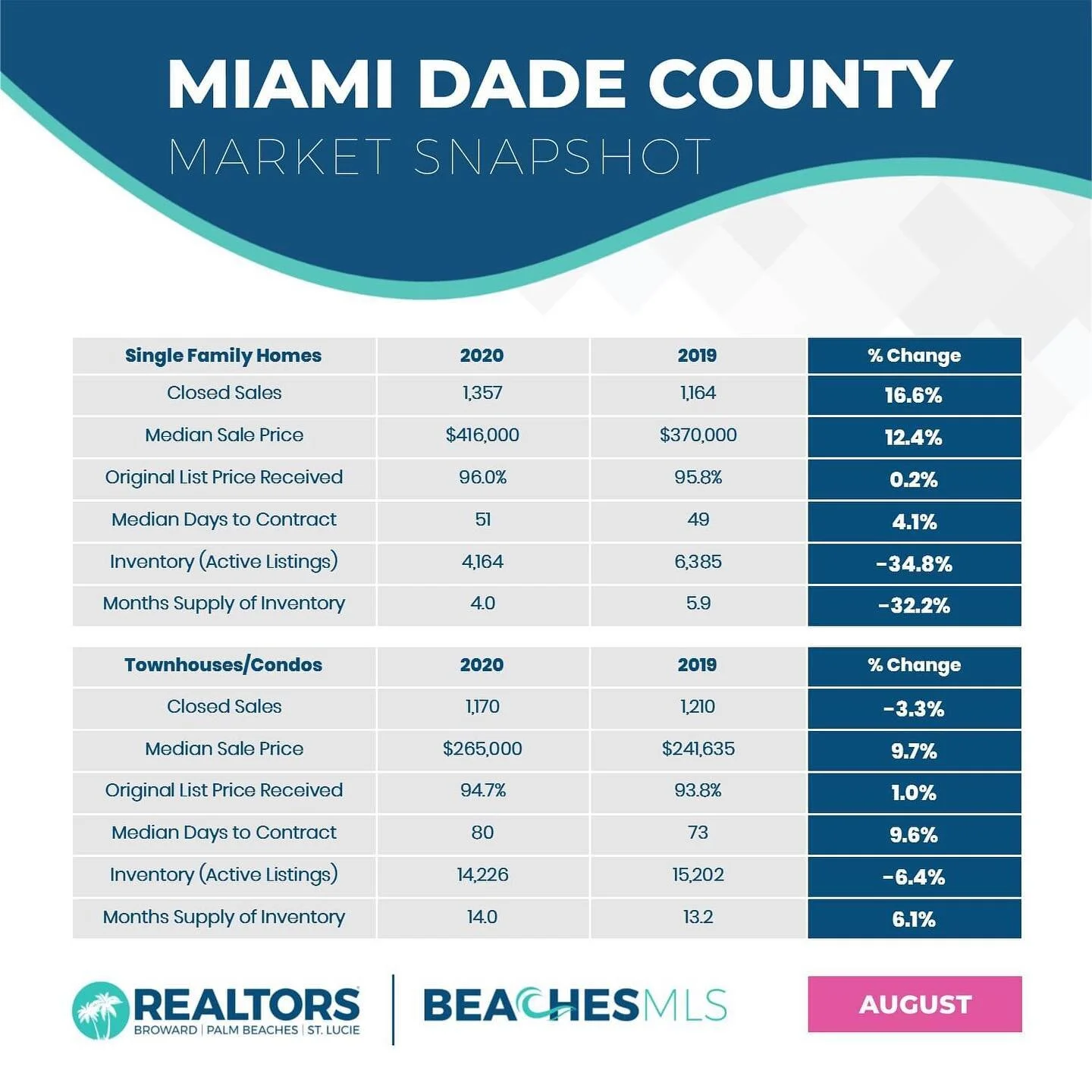

August Numbers Are In.

The August numbers are in. Amazing.

Adverse Market Refinance Fee Implementation Delayed

…I’m guessing that it will never actually be implemented.

Do It NOW.

I’m a little apprehensive to post this because it’s kind of illusory.

These are what we call “par” rates, meaning no overhead or margins are worked into the rate (so unless you have a lender that is interested in working for free or has no expenses, these would be possible). Still, the chart, as a comparison, is a good indicator of where rates have been historically relative to where they are now.

And believe me this cannot last. When we come out of this Virus madness, give it a couple of years and rates are going to skyrocket. I see no way they can’t.

“Then I’ll just wait then”. The problem with that is you don’t know what the future holds either. What if your job disappears? What if lenders modify eligibility (as they have been doing)? If you qualify now, I beg you to consider refinancing.

New PPP Rules

Repost from Forbes: https://www.forbes.com/sites/allbusiness/2020/06/05/trump-signs-new-law-relaxing-ppp-rules-what-you-need-to-know/#30842a7f31e3

By Neil Hare

In a rare display of bipartisanship, on June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act (PPPFA) in an attempt to address many concerns expressed by the small business community around the Paycheck Protection Program (PPP) aimed at providing COVID-19 relief.

On May 27, 2020, the House passed the PPPFA by 417-1 and the Senate approved it by unanimous consent on June 3. The new law addresses the following flaws in the original PPP program created under the CARES Act:

1. PPPFA changes amount of loan needed for payroll to 60%

The biggest complaint around the PPP loan program was that it required businesses to spend 75% of the loan on payroll. For those businesses shut down due to COVID-19, this meant playing the role of unemployment office, paying their workers to stay home and do no work. The PPPFA reduces the amount of the loan needed to be spent on payroll from 75% to 60%, thus increasing the amount of funds available for other expenses from 25% to 40%.

While this new breakdown was less than the 50-50 split business groups advocated for, it is still an improvement.

However, the law does not change the list of expenses eligible for forgiveness. It still includes rent, mortgage payments, utilities, and interest on loans. Again, this is quite a restriction on businesses that need funds for inventory, personal protection equipment, expenses around remote working, and other needs. Business groups will continue to lobby to expand eligible expenses.

2. PPPFA extends time period to use funds from 8 to 24 weeks

The second biggest issue around PPP was that it required businesses to spend the funds in the eight-week period from the date funds were received. For a business shut down by government mandate, this amounted to spending funds when, perhaps, conserving them was in order. Business owners clamored to have the flexibility to spend the loan after reopening, especially on payroll when workers returned to work and were not sitting idle.

The PPPFA fixed this by extending the time period to spend the loans to 24 weeks. While businesses will still need to spend the money on payroll and authorized expenses, they now have until the end of 2020 to do so.

Presumably, this will make receiving complete loan forgiveness more likely since the loan amount was based on one month of 2019 payroll multiplied by 2.5, which equals approximately 10 weeks. Businesses should now have the flexibility to spend the PPP funds when they like for the remainder of the year. And, another positive caveat: the PPPFA also does not require businesses to wait for 24 weeks to apply for forgiveness and can still do so after eight weeks if they prefer.

3. PPPFA pushes back a June 30 deadline to rehire workers to December 31, 2020

Small businesses took issue with the PPP requirement that all workers had to be rehired by June 30, 2020, in order for their salaries to count towards forgiveness. Many businesses were concerned they might not be open, or certainly not at full capacity by this date, and would once again, be required to pay employees for not working.

Under the new law, businesses now have until December 31, 2020, to rehire workers in order for their salaries to count towards forgiveness.

It is important to note, however, that the law did not change how salaries are calculated towards forgiveness.

The payroll calculation used in the loan application still applies to the forgivable amount. So, employee compensation eligible for forgiveness is still capped at $100,000, and until further guidance, employer owners and contractors are still capped at $15,385. Presumably with the new law, however, having an extra six months of expenses eligible for forgiveness will make up for any gaps and ensure 100% forgiveness of the loan.

4. PPPFA eases rehire requirements

As the intent of PPP was to keep the same number of employees on the payroll as was used to calculate the loan, it required a business to rehire the same number of full-time employees or full-time equivalents by June 30, 2020.

The only exception to this rule was if an employer could document in writing an attempt to rehire an employee who rejected this offer.

The new law makes two significant changes to these requirements. First, it extends the rehire date to December 31, 2020, and second, it adds additional exceptions for a reduced head count. The law states a business can still receive forgiveness on payroll amounts if it:

Is unable to rehire an individual who was an employee of the eligible recipient on or before February 15, 2020;

Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020; or

Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020.

It remains unclear how to “demonstrate the inability to rehire similarly qualified employees” or what the standard “to demonstrate the inability to return to previous levels of business activity” would be, but hopefully forthcoming guidance will elaborate. The good news appears to be that even with a reduced head count based on these exceptions, if 60% of the loan is still used on payroll throughout the remainder of 2020, it will be forgiven. Certainly, a business will need to document in writing as thoroughly as possible its efforts to rehire employees through December 31, 2020.

5. PPPFA extends the repayment term from 2 years to 5

The new law also eases repayment terms in the event loans or portions of them are not forgiven. A business now will have five years at 1% interest to repay the loan. Further, the first payment will be deferred for six months after the SBA makes a determination on forgiveness. Since under current regulations your bank has 60 days to make a forgiveness determination and the SBA an additional 90 days, this means you could have up until May of 2021 to make the first payment on the loan.

In addition, the PPPFA also allows borrowers to take advantage of the CARES Act provision allowing deferment of the employer’s payroll taxes for Social Security.

Previously, PPP did not permit deferment of these taxes on the forgivable portion of the loan.

Treasury guidelines still provide for SBA loan audits

While this new law certainly addresses many concerns, and should ease the requirements for full forgiveness of PPP loans, it is not a complete fix. Namely, it does not address the issues around SBA audits of loans as outlined in the Treasury Department “Interim Final Rules” on PPP loans issued late on May 22.

According to PPP Loans FAQs, the SBA could audit any loan at its discretion to determine if “the borrower may be ineligible for a PPP loan, or may be ineligible to receive the loan amount or loan forgiveness amount claimed by the borrower.” This includes loans under $2 million, which have a “safe harbor” on the issue of whether economic uncertainty made the loan necessary.

So, despite the changes to PPP, the SBA can still look at how a business calculated the original loan amount and review whether it had “access to credit elsewhere” when determining if all or a portion of the loan should be forgiven. All businesses, especially those with loans in excess of $2 million, should prepare to explain why the funds were financially necessary at the date of application.

This comes down to the issue of liquidity. Did a business have large cash reserves or lines of credit it could have tapped to stay afloat during the shutdown? If so, the SBA may determine the borrower was ineligible for the PPP loan. While borrowers should not worry about criminal penalties if such a determination is made, outright fraud excepted, they could be required to repay the loan in full.

It remains doubtful that the SBA will conduct many audits of PPP loans, as almost 4.5 million have been doled out, and it simply does not have the capacity to review many.

That being said, thorough documentation of the financial health of the business at the time of the loan application and detailed tracking of how the loan is expended will prevent any issues down the road. It is important to note that the responsibility for accurately calculating the loan amount and the forgiveness amount rests with the borrower.

Conclusion

All in all, the PPPFA is a win for small businesses. The law will ease many of the burdens placed on businesses that received PPP loans, and for many that may still apply for them. It is also positive that politicians on both sides of the aisle listened to small business owners and took quick, decisive action, putting their constituents before partisan wrangling.

There are still plenty of questions left unanswered and fixes necessary, however, so more regulations will be forthcoming with more changes to the PPP program for sure.

Do You Know the Terms?

A Graph Worth a Thousand Words.

If you were waiting for the perfect time…. that time would be now.

Please reach out. We’re working remotely for the time being but we’re at 100% capacity so much so that I’m starting to get used to this. Actually our productivity has improved.

Anyway, this is when you pull the trigger. Let us know.

Guest post: 7 ways to help recession-proof your finances

Mary Kate Mackin from her offices at Bankrate, Inc, in New York City reached out recently and asked that I publish this on my blog.

I don’t know how to do that. So I am copying the URL below so you all can read it for yourself and I have cut-and-pasted the article by Sarah Foster below. Some good tips there.

https://www.bankrate.com/personal-finance/smart-money/ways-to-recession-proof-your-finances/

It’s not often that almost every American knows in real-time that an expansion has ended and a recession has begun — but the novel coronavirus is proving to be historic for more reasons than one.

Americans were in the middle of the longest economic expansion on record, a slow-but-steady recovery that took nearly a decade for wage growth and employment to catch back up after the Great Recession. But in a matter of days, confirmed cases of the deadly, contagious pathogen skyrocketed across the globe, forcing states to impose stay-at-home restrictions that have ultimately led to millions of layoffs and shuttered businesses.

More than 10 million Americans filed for unemployment in March, with virtually every industry seeing job loss, according to Department of Labor data. Meanwhile, estimates from Federal Reserve economists predict that joblessness could soar to 32.1 percent — higher than even during the Great Depression.

“This is so unprecedented in its sudden-stop nature,” says Nick Bunker, economic research director at the Indeed Hiring Lab. “It’s directly impacting industries that are not usually the front line of recessions.”

Expert tips to help make your finances recession proof

Americans won’t know for sure that they’re living in a recession until the National Bureau of Economic Research’s Business Cycle Dating Committee says so. This private, nonprofit group of economists is the sole arbiter of declaring when a recession starts and ends.

Typically, it takes months, if not a year, for the group to announce that exact timeline. The committee, for example, declared in December 2008 that the Great Recession began in December 2007.

A recession isn’t always characterized by a sudden plunge in business activity. Textbooks typically define the starting point of a downturn as the point when things just aren’t as good as they were.

But even though the economic outlook is looking grim right now, it’s never too soon to ensure that your finances are well-equipped to weather any storm. Here are seven tips to help recession proof your finances, as recommended by experts.

1. Pay down debt

It’s crucial that you pay down any outstanding debt — more specifically, high-cost debt, such as your credit card balance — to create some breathing room in your budget.

As the coronavirus has demonstrated, economic downturns can often lead to job loss. If you’re worried about job security, paying off your obligations might bring you more peace of mind.

Prioritize credit card debt, then turn to other types of loans, such as mortgages or auto loans. Student loans, however, have more favorable provisions, which makes paying them off less of an urgency, says Greg McBride, CFA, Bankrate chief financial analyst.

Even if you’re not worried about losing your job in a downturn, it’s still good financial practice. A March 2019 Bankrate survey found that 13 percent of Americans aren’t saving more because of the amount of debt that they owe.

“Regardless of where we are in a market cycle, prioritize eliminating high-interest rate debt no matter what,” says Lauren Anastasio, CFP, a wealth adviser at SoFi, a personal finance company. “Being in a position where you’ve eliminated those types of high-cost obligations allows you to better prepare for other things financially. The more you’re able to put aside for saving and the less debt you have, it’s going to be available to you in case of an emergency.”

Use Bankrate’s tools to calculate a debt-payoff plan or take advantage of balance-transfer credit cards with zero percent intro APRs. These offers disappeared in 2008, Anastasio says, so they’re likely not going to be around when the next downturn comes.

2. Boost emergency savings

Job loss can also make it difficult for Americans to pay their day-to-day expenses.

Beefing up your emergency fund — that is, the pool of cash that you reserve specifically for events like downturns — can make it possible for you to still afford your necessities while you search for a new position.

Even if you’re paying down debt, it’s important that you prioritize saving. Focus first on loading up your emergency fund with one month’s worth of living expenses. After that, pay off your debt, and then focus on building up a reserve of three-to-six months worth of funds, Anastasio says.

“Everyone needs to have a cash cushion, even while they’re attempting to pay off high-interest rate debt,” Anastasio says. “It’s imperative because, if an emergency arises and you’re putting every dollar toward eliminating debt, you have no choice but to go back to credit cards to cover the expense.”

A high-yield savings account can help you earn more on the money you stash away. Shop around for the best account that suits your needs and lifestyle.

3. Identify ways to cut back

It’s always a good idea to go through your monthly expenses and identify which items are discretionary — services or items you don’t need — and which items are a necessity. The discretionary items are most likely ones that you can either eliminate now or in the future, McBride says.

“Certainly your starting point would be the discretionary items — subscription services or even just spending patterns,” McBride says. “Dinners out or nights out at the bar with friends can seriously add up over time.”

4. Live within your means

Experts typically recommend spending no more than 30 percent of your net income (that is, earnings after taxes) on discretionary items. It’s a good idea to create a monthly budget to ensure that you’re living within your means and not overspending.

“You have to pay your rent; you have to pay your car insurance; you have to eat to live. Your groceries, your utilities — those are all going to be essential expenses,” Anastasio says.

“But dining out, vacations, cable — anything that you would potentially consider a luxury or a lifestyle expense — that’s discretionary spending.”

(Create a monthly budget using Bankrate’s tools and calculators.)

5. Focus on the long haul

After addressing your emergency savings and paying off your debt, your next worry when thinking about a downturn might be about your investments. The thought of the markets plummeting might make you fearful that you’ve lost all of your earnings after years of hard work.

Changing your strategy, however, would be the worst thing you could do, McBride says.

“It will take a tough stomach, because in a recession a stock market will easily fall 30 to 40 percent, peak to trough, but making regular contributions and reinvesting all of the distributions will make those market gyrations work to your benefit,” McBride says. “A recession is a tremendous buying opportunity.”

That goes for all individuals, whether you’re 20 or two years away from retiring, he says. If you’re planning to retire in the next few years, when a recession looks like it could be coming, it might be a good idea to have your first few years of withdrawals already in cash. But don’t shy away from equities in your portfolio. Those are often where you’ll get the most returns that provide inflation protection, he says.

“Do not make changes that jeopardize your long-term financial security based on short-term economic events,” McBride says. “Even for someone who is on the cusp of retirement, retirement is going to last 25 to 30 years. A recession is going to last a year.”

6. Identify your risk tolerance

Still, it might not be a bad idea to work with a financial adviser on identifying your risk profile, Anastasio says. That includes identifying your risk tolerance — or how much risk you can afford to withstand — and your risk appetite — or the amount of risk you’re willing to take on.

Risk suitability is also another important factor, Anastasio says, a component that’s based on when someone plans on cashing out their investments. If you’re going to change your investing strategy at all, let it be based on this, she says.

“The sooner we expect someone to use the money, that’s where they’re going to need to be more conservative with their options: high-yield savings accounts, CDs,” Anastasio says. “On the other end of the spectrum, when we’re looking to invest for eight to 10 years or longer, that’s when it tends to be more appropriate to be invested in equities or stocks as a whole.”

7. Continue your education and build up skills

But to recession-proof your life, one of the best investments you can make is pursuing an education, says Tara Sinclair, an economics professor at George Washington University and a senior fellow at Indeed’s Hiring Lab. During recessions, the unemployment rate for those with a bachelor’s degree or higher is much lower than for those who have a high school education or less.

“Economists are always emphasizing the importance of education,” Sinclair says. “That’s something, even if you can’t build up a financial buffer, focusing on making sure that you have some training and skills that are broadly going to be employable is really crucial.”

Why predicting recessions is difficult

The novel coronavirus underscores just how difficult it is to predict what will cause that turning point. At the beginning of 2020, a rapidly spreading contagion wasn’t on anyone’s radar.

Even worse, information is often revised, updated and corrected. It’s released with a lag. Even so, developments shift rapidly. Fed officials, for example, pledged to keep interest rates steady through all of 2020. But they ended up slashing rates to near-zero at two emergency meetings, as the coronavirus devastated financial markets and the U.S. economy.

“Some people say economists exist to make weather forecasters look good,” Sinclair says. “The complexity of the macro economy is such that we haven’t yet figured out a clear, causal model of how things work. We can’t predict with any kind of confidence what’s going to happen, particularly when things are changing dramatically.”

Plan for the unexpected when it comes to the economy

Recessions are typically defined as a drop in output or a slowdown in growth. Though most economists would lump the two causes of recessions into supply shocks or demand shocks, each of the past 33 recessions (as tracked by the NBER Business Cycle Dating Committee) have been caused by something a little different, Sinclair says.

“Obviously, if recessions were easily predictable and preventable, we’d expect policymakers to be doing just that,” Sinclair says. “If we think back to 2007, many people asked, ‘How did we not see it coming?’ But that’s the nature of recessions. They are these terrible things that we can’t predict.”

Even so, economies don’t always react to shocks in the same way. Markets panicked after the Fed in December hiked rates for the fourth time in 2018, fearing that too much monetary policy tightening would spur a downturn. The markets, however, bounced back in 2019, flirting with new highs.

If officials make progress containing the virus, investors will likely calm down.

Bottom line

It’s hard to predict the future when you’re using the past as a guide, Sinclair says.

“Our economy is changing so dramatically,” according to Sinclair. “There’s many different sources that can lead to a recession, and it tends to be that when we look out for the next one, we’re looking for the same things that caused the recession rather than recognizing that there’s a new source.”

But you can take solace in the fact that economists are generally much better at knowing whether the U.S. economy is in a recession, Sinclair says. Even though predicting them is close to impossible, you won’t have to wait long before knowing that the U.S. economy is in one. That’s the case with what’s happening right now.

Downturns never come at a good time, but that was even more so with the coronavirus. Many Americans were already living paycheck-to-paycheck, while an October 2019 Bankrate survey found that 2 out of 5 Americans (or 40 percent) aren’t prepared for the next recession.

Regardless of whether the storm is on the horizon, it’s always a good time to make sure your financial portfolio is prepared, Anastasio says.

“I don’t think there’s ever a bad time to evaluate their finances and check in with themselves,” Anastasio says. “If someone personally feels nervous that there’s change on the horizon, it’s always a good time to say, ‘What can I do personally to put myself in a stronger financial position, so I can sleep better at night when the time comes.’”

Our Covid-19 Message:

Hi,

The recent spread of Covid-19 has caused many organizations to move to a contingency plan, and OCF Financial is not different. As of Tuesday, March 17th, we decided to have our team members work remotely and to practice social distancing as much as possible.

When we made this decision we were concerned we would see a drop-off in productivity, and this at a time when our volume had reached record levels.

I am surprised and very pleased to announce that we have seen no decline in our productivity, and our service to our clients has been exemplary.

There have been changes that nobody could foresee in the market; but I am confident this is going to resolve itself extremely quickly and that are recovery is going to be so swift and complete it will surprise even the optimists.

When others stepped away, we really stepped up; and I couldn’t be more proud.